When we think about investing, our minds often jump to stock tickers, crypto charts, or real estate trends. But long before Wall Street existed, before currencies, credit ratings, or even banks, human beings were making strategic decisions about where to place their resources for the greatest return. And they were doing it remarkably well.

That’s why revisiting the investing lessons from ancient civilizations isn’t just a history lesson, it’s a deep well of timeless wisdom. From the Egyptians and Mesopotamians to the Greeks, Romans, and ancient Chinese dynasties, these societies invested in agriculture, infrastructure, human capital, and trade networks with principles that still echo in today’s financial world.

What if modern investors stopped chasing trends for a moment and started listening to the past?

The Foundation of Ancient Wealth

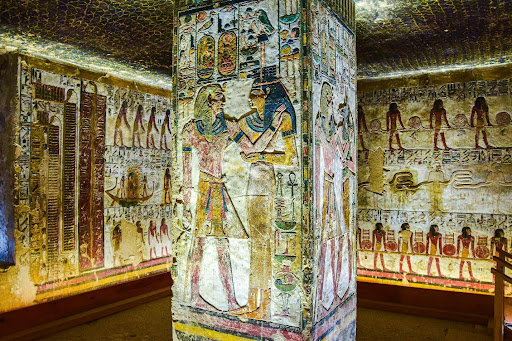

Take the Egyptians. Their monumental pyramids weren’t just burial sites, they were built as generational investments, designed to showcase the wealth, power, and stability of a ruling dynasty. Constructing one took decades, thousands of workers, and careful planning of labour, materials, and logistics.

You might not be building a pyramid, but the takeaway is clear: real value often takes time to build. Whether you’re investing in property, education, or a business, patience and vision matter more than immediate returns. This kind of long-term wealth-building technique is rare in today’s fast-paced, “get rich quick” environment.

Diversification Isn’t New, It’s an Ancient Strategy

The concept of “don’t put all your eggs in one basket” didn’t start with mutual funds. Ancient Mesopotamians, for example, were some of the first to record diversified investments in clay tablet contracts. A merchant might allocate resources to trade caravans, livestock, and grain production all at once. Why? Because if one failed, due to drought, bandits, or war, the others could still bring returns. Even the Roman Empire operated on a massive diversification model. From olive oil to wine, from North Africa to Britain, Rome didn’t rely on a single economic engine. It built systems across regions and industries, minimizing risk while maximizing reach. When we talk about financial independence through discipline today, we’re echoing decisions made thousands of years ago.

When we talk about balanced portfolios today, we’re echoing decisions made thousands of years ago, by people who understood that resilience requires spread.

Investing in Infrastructure

Not all investments yield financial return immediately. Some, like infrastructure, create foundations for future prosperity. The ancient Chinese invested in the Grand Canal and the Silk Road, not just as trade routes, but as systems that would expand influence, build wealth, and connect cultures. Rome’s investment in roads and aqueducts wasn’t just civic pride, it was about moving goods, water, and armies efficiently. These were literal pipelines of return. In today’s context, investing in systems like digital transformation in education can create lasting impact in different sectors.

What’s the lesson for modern investors? Sometimes the best investment isn’t a stock or fund, it’s a system. That might mean upgrading your tools, investing in learning platforms, or building your network. Infrastructure matters, whether it’s made of stone or code.

Emotional Discipline

Greed and fear didn’t start with the stock market either. In ancient Athens, panicked reactions to rumours of war would send grain prices soaring overnight. Traders who stayed calmly gathered information and waited out the panic often found better deals and more favourable terms. The same thing happened in medieval marketplaces where sudden news, true or false, would swing market values wildly.

The wise ones didn’t act out of emotion. They acted with intention. One of the strongest ancient civilizations is learning how to manage emotions. Whether in the agora or a modern trading floor, emotional discipline in investing always beats speculation.

Human Capital Was Always Valuable

The Inca didn’t use money. Their currency was labour. The way they built their empire, using communal investment in skilled labour, knowledge sharing, and long-term training, teaches a lesson modern business still wrestles with: people are assets, not costs. Educating scribes in ancient Sumer or training artisans in ancient India weren’t seen as luxuries. They were seen as investments that would yield generations of productivity, innovation, and culture.

In today’s world, that translates to investing in personal development, mentorship, and upskilling. Whether you’re a business owner or an individual, pouring into people pays off, because it creates exponential value over time.

Trading Networks and the Value of Connection

When the Phoenicians set sail across the Mediterranean, they weren’t just exporting goods, they were investing in relationships. Trade networks in the ancient world were built on trust, shared benefits, and long-term cooperation. You might not be loading cargo on a ship, but you’re still investing in networks. Your relationships, collaborations, partnerships, and reputation form the bedrock of opportunity. Even today, AI impacts daily life in similar ways by connecting people across the globe.

Scarcity, Inflation, and Supply Chain Strategy

During the Han Dynasty, officials had to manage fluctuating grain prices due to droughts, over-farming, and war. They developed early versions of price control and storage strategies, buying and storing grain in years of abundance to release during shortages. This smoothed out inflation and prevented famine.

Today’s equivalent? Investing with awareness of supply chains, market cycles, and global instability. If a 2000-year-old dynasty could strategize around volatility, modern investors can too.

Ethics and Value

Not every investment is material. Ancient philosophers like Confucius and Socrates encouraged investing in virtue, legacy, and knowledge, not just in wealth. Even in the most economically driven societies, there was room for questions of ethics. In ancient Babylon, contracts had clauses for fairness. In early Islamic finance, profit had to be earned without exploitative interest.

As modern investing becomes increasingly driven by ESG (Environmental, Social, and Governance) criteria, we’re circling back to values long embedded in ancient systems: that wealth without responsibility isn’t truly valuable. This subtle but powerful concept shapes how many thoughtful investors now choose companies, funds, or causes to support.

Lessons That Still Echo Today

The ancient civilizations remind us that while technology changes, human nature doesn’t. Risk, reward, fear, patience, value, trust, these concepts have always been part of our collective pursuit of progress. By looking backwards, we gain clarity on how to move forward. We’re reminded that wealth built slowly, through wise decisions and ethical frameworks, lasts longer and serves more people.

And perhaps most importantly, we’re reminded that no one invests in isolation. Whether on a Phoenician ship or behind a laptop screen, we’re all part of something larger, something shaped by our values, our choices, and our history.

Conclusion

In a world obsessed with new trends, it’s easy to dismiss the past. But those who’ve studied Investing Lessons from Ancient Civilizations know this truth well progress isn’t linear, it’s cyclical. What worked once often works again, if we have the wisdom to see it.

The next time you check your portfolio, chase a stock tip or plan your next big investment, pause. Ask yourself what the Egyptians, the Romans, or the merchants of Mesopotamia might have done. You might just find that your most successful strategies are older than you think. Because sometimes, the future of investing is written in the oldest stories we’ve got.